The Basic Principles Of Estate Planning Attorney

The Basic Principles Of Estate Planning Attorney

Blog Article

The Main Principles Of Estate Planning Attorney

Table of ContentsThe Basic Principles Of Estate Planning Attorney Rumored Buzz on Estate Planning AttorneyEverything about Estate Planning AttorneyGetting My Estate Planning Attorney To Work

Estate preparation is an activity strategy you can make use of to establish what happens to your properties and obligations while you live and after you die. A will, on the various other hand, is a legal record that details just how properties are distributed, who deals with children and animals, and any various other desires after you pass away.

The executor also needs to pay off any kind of tax obligations and financial obligation owed by the deceased from the estate. Creditors generally have a limited quantity of time from the date they were alerted of the testator's fatality to make claims against the estate for money owed to them. Claims that are denied by the administrator can be brought to justice where a probate judge will certainly have the final say as to whether the insurance claim is legitimate.

Examine This Report on Estate Planning Attorney

After the stock of the estate has actually been taken, the worth of assets computed, and taxes and debt paid off, the administrator will then seek permission from the court to distribute whatever is left of the estate to the recipients. Any kind of estate taxes that are pending will come due within nine months of the date of fatality.

Each individual areas their assets in the count on and names someone aside from their partner as the recipient. Nonetheless, A-B trust funds have actually ended up being much less preferred as the inheritance tax exception works well for most estates. Grandparents may transfer assets to an entity, such as a 529 plan, to support grandchildrens' education.

The 9-Second Trick For Estate Planning Attorney

Estate organizers can function with the contributor in order to lower taxable earnings as an outcome of those contributions or formulate techniques that make best use of the result of those donations. This is another approach that can be utilized to limit death tax obligations. It includes a private securing the current value, and therefore tax obligation liability, of their residential property, while connecting the worth of future development of that capital to another individual. This technique entails cold the value of a property at its worth on the date of transfer. As necessary, the amount of potential funding gain at death is additionally iced up, enabling the estate planner to approximate their possible tax liability upon fatality and far better prepare for why not try these out the payment Click This Link of income taxes.

If enough insurance coverage profits are available and the policies are effectively structured, any revenue tax obligation on the deemed dispositions of properties complying with the death of an individual can be paid without considering the sale of assets. Profits from life insurance policy that are obtained by the beneficiaries upon the fatality of the insured are usually earnings tax-free.

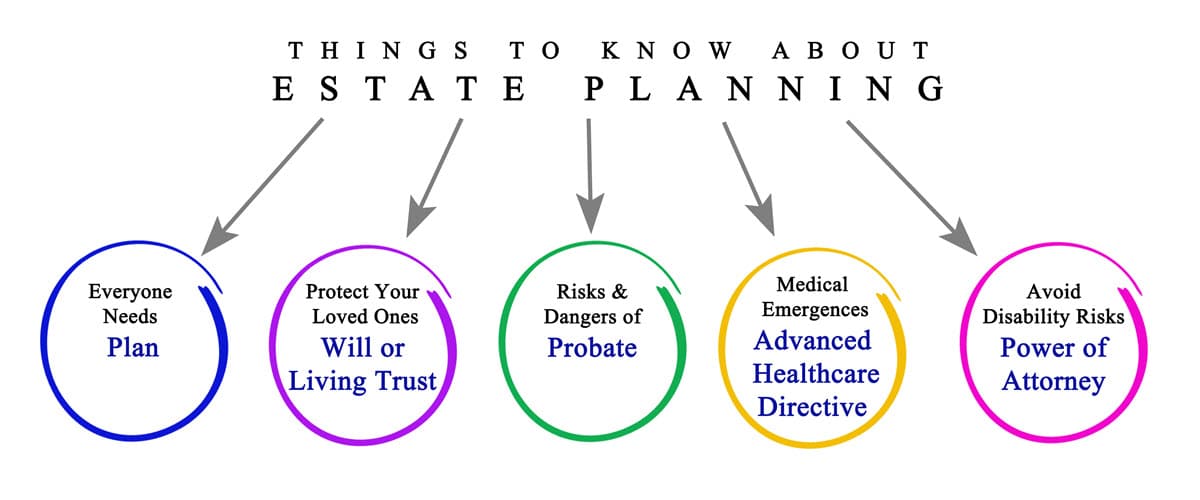

There are particular documents you'll require as part of the estate planning process. Some of the most common ones include wills, powers of attorney (POAs), guardianship designations, and living wills.

There is a misconception that estate planning is just for high-net-worth people. Estate intending makes it simpler for individuals to establish their wishes before and after they pass away.

Some Known Details About Estate Planning Attorney

You must start planning for your estate as soon as you have any type of quantifiable asset base. It's a continuous procedure: as life advances, your estate plan need to shift to match your circumstances, in line with your new objectives.

Estate planning is frequently taken a device for the rich. However that isn't the instance. It can be a beneficial means for you to take care of your possessions and obligations prior to and after you die. Estate preparation is additionally a terrific way for you to click resources outline prepare for the care of your small youngsters and family pets and to outline your want your funeral service and favorite charities.

Applications should be. Qualified applicants that pass the test will certainly be officially certified in August. If you're qualified to rest for the exam from a previous application, you might file the short application. According to the guidelines, no qualification shall last for a period longer than 5 years. Discover when your recertification application schedules.

Report this page